This blog post is the second in our series, “Unlocking the Programmable Network.” In Part 1: The State of Telco Network APIs, we summarized the landscape, presented a taxonomy, and summarized the predominant Telco Network API ecosystem—GSMA Open Gateway. Part 2 highlights why operators are pursuing Telco Network APIs, and illustrates how they will boost their entire value proposition in a Cloud- and AI-dominated world.

I. Executive Summary

The telecommunications industry is coalescing around a global network API framework to enable enhanced agility, network programmability, and network intelligence. Communications Service Providers (CSPs) seek to transform themselves from basic utilities into platform enablers by exposing network intelligence through standardized Application Programming Interfaces (APIs). This shift is critical for monetizing the massive investments in 5G Standalone (5G SA), and related Cloud and, more recently, AI initiatives globally.

While CSPs are seeking differentiation to tap the multi-billion USD opportunity and find that pot of gold at the end of the rainbow, they must ironically collaborate on standards that accelerate broad acceptance by motivating application developers to exploit high-value network intelligence.

The stakes are considerable. Worldwide revenues for Telco network APIs are estimated to climb from $700M $USD in 2023 to $6.7B by 2028, representing a 57% Compound Annual Growth Rate (CAGR). Furthermore, enabling advanced use cases via APIs is capable of unlocking $100-300B in potential over the next five to seven years.

Mounting industry pressures and significant operational roadblocks intensify a sense of urgency. Without a standard, CSPs risk ceding up to two-thirds of the incremental value to hyperscalers and other ecosystem players who are actively seeking to disintermediate the carrier-to-enterprise relationship. In response, CSPs have successfully converted trials into deployments in 2025, as the market for open APIs expands.

II. Commercial Driver 1: Defending Against Commoditization

Commoditization Crisis

For decades, CSPs have struggled to elevate the value of their service offerings beyond connectivity. The industry’s reliance on rigorous standardization, while crucial for global interoperability, has homogenized service offerings, thereby stagnating revenues. CSPs striving to enhance value must innovate beyond increasing capacity. Enter Telco Network APIs.

Threat of Disintermediation

CSPs have shared concerns that hyperscalers are taking over an increasing number of communication services (e.g., backbone networks, contact centers, etc). AWS, Google Cloud (GCP), and Microsoft Azure have positioned themselves as potential intermediaries for distributing network APIs, aggregating telco capabilities into their cloud platforms. If telcos fail to offer seamless, standardized access to their unique capabilities (such as location and guaranteed QoS), they risk ceding the market opportunity to others, who will ultimately capture value streams above 5G and innovate with AI.

Learning from Past Failures: The Need for Developer Scale

Previous attempts to standardize Telco Network APIs, such as ETSI Parlay and GSMA OneAPI, fell well short of lofty expectations, primarily due to complexity and fragmentation. To avoid repeating the fate of messaging—where value leaked to Over-The-Top (OTT) players like WhatsApp—cost-effective, ubiquitous distribution, and widespread developer adoption are essential. The complexity of integrating individual telco APIs- usually needing months- must be dramatically reduced.

Standardization and Harmonization

The industry's response is the unified global API framework based on GSMA Open Gateway to expose network intelligence. Large enterprises and multinational corporations want to use telecommunications platforms consistently across the vast geographies and networks they operate in. The initiative is backed by operators accounting for nearly 80% of global mobile subscribers, as well as major infrastructure technology providers.

III. Commercial Driver 2: Opportunity to increase revenues (and margins)

Driving New Revenue Streams

The market for network APIs is driven primarily by monetization of network intelligence—not just raw capacity. Because this opportunity is so broad, market projections vary dramatically (see Figure 1), but one thing is clear: it represents 10s to 100s of Billions of USD over the next 5-7 years.

Figure 1: Revenue Trajectory, Telco Network API

Proven Use Cases

Fraud prevention and identity services have emerged as high-value use cases that drive network API demand and are currently the largest near-term revenue drivers.

Authentication & Verification: APIs like SIM Swap Check and Number Verification address immediate, high-cost enterprise pain points by significantly reducing financial risk and fraud, preserving brand reputation.

Examples: Brazilian carriers (Telefónica Vivo, Claro, and TIM) pioneered commercial anti-fraud API launches in late 2023. Singtel’s SingVerify service uses the Number Verification API to curb fraud and streamline two-factor authentication for financial services customers.

Monetizing Experience

The Quality on Demand (QoD) API enables applications (e.g., AR/VR, gaming, remote surgery) to dynamically request guaranteed performance, tailoring network behavior to high-value applications. QoD enables carriers to charge based on a guaranteed experience rather than merely best effort, which is key for monetizing advanced 5G SA capabilities.

Example: China Telecom partnered with GrowthEase on the Reliable Link Drone project, integrating QoD, Geofencing, Location Retrieval, and Location Verification APIs to assure high-quality video streaming during drone inspections, facilitating real-time remote control for safety.

New Monetization Models

APIs facilitate a critical shift in monetization from legacy fixed subscriptions to flexible usage-based pricing, which has already achieved considerable momentum in the Enterprise API markets. New models include transaction-based fees (per query or per verification) and revenue sharing with aggregators and cloud partners. Direct carrier billing (DCB) APIs support this route to market, with revenue projected to reach $49.3 billion in 2025 at a 12% CAGR.

IV. Strategic Enablers

The Need for Global Scale

To successfully serve large global enterprises, Telco network APIs must accelerate time-to-market across networks and geographies. Developers require application portability, paralleling the expectations set by hyperscalers.

To motivate adoption, CSPs must facilitate the application development journey by streamlining onboarding, offering easy-to-learn-and-use API development environments (e.g., sandboxes, tools, documentation, etc), and ensuring consistency across networks. Shifting the perspective from infrastructure to software is critical to compete against the hyperscalers.

Standardization and Open Source Initiatives

GSMA Open Gateway: Launched in early 2025 with 21 members, Open Gateway provides the unified global framework and common API definitions, supported by 74 operators (October 2025), accounting for nearly 80% of global mobile subscribers.

Linux Foundation CAMARA: Open-source companion to Open Gateway. CAMARA specifies technical API requirements and provides reference implementations (SDKs, documentation). As of October 2025, the Linux Foundation reports that CAMARA has defined 60 APIs, with contributions from 1,300 contributors across 476 organizations.

The Marketplace and the Aggregation Imperative

In addition to the API framework, enterprises and their application development partners require a robust marketplace to readily obtain and adopt the emerging Telco Network APIs. Multiple industry initiatives have been launched to bridge the gap between supply and demand:

Aduna Joint Venture: Launched in July 2025, Aduna JV is a 50-50% joint venture between Ericsson and a dozen major operators to offer Open Gateway APIs. Aduna leverages Ericsson’s API platform, acquired through its 2024 acquisition of Vonage.

Bridge Alliance API Exchange (BAeX)- Bridge Alliance is comprised primarily of 30+ Asia-Pacific operators. The BAeX offers a Telco Network API marketplace, including the OpenGateway / CAMARA APIs.

Notable Exception - Nokia decided not to join Aduna and has embarked on its Network as Code initiative. The platform is based on Rapid’s API Hub technology, which Nokia acquired in 2024. Nokia makes APIs available that expose both 5G and 4G capabilities; Nokia also contributes to the Open Gateway, CAMARA, OpenAPI, and Mplify (MEF) API initiatives.

V. Geographic Perspective

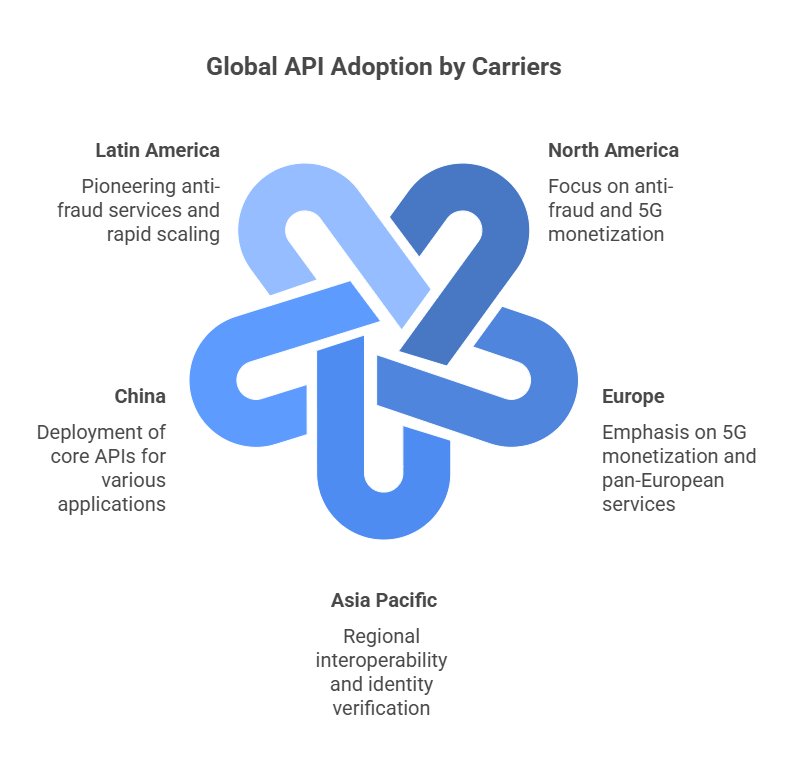

Major carriers globally are driving API adoption, with a range of regional use cases as summarized in Figure 2, and addressed below:

Figure 2: Global CSPs API Adoption Priorities

North America

The initial joint commercial pilot APIs for Number Verification and SIM Swap launched in late 2023, and the commitment grew into a much larger partnership, with AT&T, T-Mobile, and Verizon all becoming equity partners in the Aduna JV. The focus remains on advanced anti-fraud solutions and 5G monetization via programmable connectivity (slicing and Edge).

Verizon exposes its QoD and Network Slice APIs directly through hyperscalers (AWS, Azure) and CPaaS providers to meet developers where they reside, leveraging the Aduna platform as a unified sales channel.

Europe

European operators emphasize monetizing 5G investments and launching pan-European services via federation.

Orange launched the dedicated LiveNet business unit in March 2025, specifically to fast-track its commercial CAMARA API catalogue via Aduna, starting with Identity and Anti-Fraud services.

Telefónica has closed agreements with 50+ large companies (as of MWC 2025) and is working with over 20 commercial partners to leverage Open Gateway APIs for global rollout (including partnering with Google Cloud to integrate the Number Verification API into the Firebase developer platform and launching a new Age Verification API with TikTok).

Deutsche Telekom is collaborating with network vendors like Nokia (via its Network as Code platform) to push the boundaries of programmable connectivity, demonstrated by use cases focused on drone fleet operations and dynamic Quality-on-Demand (QoD).

Asia Pacific

Regional emphasis centers on identity verification, fraud prevention, and regional API federation.

Singtel continues to drive regional interoperability through the Bridge Alliance, which officially partnered with Aduna in H1 2025, significantly expanding the global reach for APAC developers.

KDDI, an Aduna founding partner, continues to maintain one of the region's largest API portfolios.

China

China Mobile, China Telecom, and China Unicom, among the world’s largest CSPs, are actively deploying core APIs: OTP Validation, QoD, SIM Swap, and Number Verification. China Telecom has publicly demonstrated the use of QoD and Location APIs for improving mission-critical use cases, such as optimizing connectivity assurance for industrial drone fleets.

Latin America

Carriers were key pioneers in the rapid commercialization of anti-fraud services. Carriers in Brazil (Telefónica Vivo, Claro, and TIM) successfully launched three core Open Gateway APIs for anti-fraud in late 2023. Additionally, América Móvil (Mexico) is a founding equity partner in the global Aduna joint venture, ensuring rapid scaling across its 20+ Latin American markets

VI. Obstacles to Overcome

Over the past 18 months, a clear industry consensus coalesced around a unified Telco Network API framework to address the most strategic challenge- elevating the CSP value proposition. Because of unprecedented and powerful competition- the hyperscalers- a growing sense of urgency motivated operators to respond to avoid further commoditization and disintermediation from customers. However, major challenges remain (see Figure 3), not including the uncertainty surrounding AI:

Figure 3: In spite of the potential, major challenges remain …

Enhancing Developer Experience (DX) Race

Despite extensive standardization and Open Source, developer readiness remains low. Telcos must aggressively match the polished DX offered by hyperscalers, and Enterprise APIs, including powerful developer portals, low-friction onboarding, extensive API education and content resources, complemented by evangelists to motivate the application developers to participate (user groups, Hackathons, etc.). DX must be prioritized at the top of the queue, shifting focus from API development to adoption.

Monetization Clarity

Uncertainty around viable pricing models (per-call, usage-based, or revenue-sharing across aggregators) continues to be a crucial hurdle that will slow adoption. Legacy BSS revenue management platforms must evolve rapidly to support the flexible, real-time, transaction-based billing and settlement that developers and enterprises expect. The process may be shortsighted by focusing on competitors (i.e., hyperscalers) that have already adopted transaction-based pricing in the market.

Maintaining Consistency and Trust

Exposing network capabilities introduces new security and privacy threats. CSPs must ensure standardized authentication and compliance with privacy laws (e.g., GDPR) for APIs carrying sensitive data. If the Security and Privacy, along with performance guarantees, are not reliably delivered, developers will lose trust in the new APIs.

The Biggest Risk of All: Organizational Inertia

The single largest risk for CSPs is losing out on the opportunity by moving too slowly. The sense of urgency and level of executive visibility have never been higher. If operators fail to execute quickly and at scale, non-telco players will inevitably step in to capture the valuable new revenue pools.

The successful operator in the coming years will be the one who treats the API market not as a new product line, but as the culmination of an enterprise-wide operational and commercial transformation.

FOR ADDITIONAL INFORMATION

To stay informed about the rapidly evolving Open Telco Network API landscape, stay tuned for subsequent posts in this series, which will reflect market developments, including: Why Enterprises are seeking Telco APIs, Business Models, What motivates developers, and what lies ahead.

To discuss your organization’s specific needs or to participate in AvidThink’s upcoming Telco Network API Research Report, please contact us today at [email protected]